Natural Gas in Southern Africa, Part 2: Available gas resources and future development

This is the second part of a 2-part series of articles covering the natural gas industry in southern Africa. For these articles, we view southern Africa as comprising South Africa, Namibia, Botswana, Lesotho, Swaziland, Zimbabwe and Mozambique. The two parts focus on different aspects of the natural gas market, as follows:

-

Part 1: Current natural gas supply and demand. This was published on the 1st of November (Putter, 2018); and

-

Part 2: Available gas resources and future development.

In this Part 2, the focus is on current and potential sources of natural gas in southern Africa and we describe a possible future scenario for natural gas.

Introduction

In the first article of this series, an overview was given of the history of the gas industry in southern Africa, a global perspective was given on gas prices and the growth in global gas demand, and the status of the current gas market and infrastructure in southern Africa was reviewed. Currently, less than 4% of South Africa’s primary energy needs are sourced from natural gas or equivalent. This compares with 14.2% for South Korea, 28.4% for the USA, and 23.1% for Germany (BP Energy Review, 2018).

It was clearly illustrated that southern Africa is lagging the rest of the world in the use of natural gas, primarily due to limited gas supply and not as a result of high gas pricing. The lack of pipeline infrastructure is also a major inhibitor to further development of the gas industry in southern Africa, together with the slow development of local gas resources.

In this article, we discuss current and potential sources of natural gas and describe a possible future scenario for natural gas in southern Africa. We believe that natural gas can easily exceed 14% of southern Africa’s primary energy needs.

Sources of natural gas in southern Africa

The current and imminent producers of natural gas in southern Africa were discussed in Part 1 of this series of articles (Putter, 2018). Two current producers are PetroSA offshore gas and the Pande / Temane gas fields in Mozambique. The Rovuma Venture is progressing their LNG project from the Mamba field offshore Mozambique with first production expected in 2024.

The lack of local gas resources is inhibiting the growth of the gas industry in South Africa. Following are a few notes on some of the southern African gas resources that could change this:

- Rovuma gas: This major gas resource in the north of Mozambique (and south of Tanzania) is one of the biggest gas fields in the world. Unfortunately, the development of floating LNG plants (such as the Rovuma venture) will do nothing for natural gas consumption in southern Africa since all the LNG will be exported. The only way for this massive natural gas resource to make a meaningful contribution to natural gas consumption in the region, would be for the gas to be brought ashore and transported to the major energy markets in the region, either via electricity generation and transmission, a major natural gas pipeline or possibly conversion to derivatives such as liquid fuels or fertilisers;

- Offshore gas: Several exploration efforts are underway to find oil and gas off the southern African coast such as Sasol offshore Mozambique, Total and ENI offshore South Africa and Eco Atlantic offshore Namibia. If the gas would be brought ashore from any of these potential developments, it could make a meaningful contribution to the gas economy in southern Africa;

- Karoo shale gas: Since this gas would be well located for distribution of energy within the region, it could certainly play an important role in the growth of the gas economy in southern Africa. Exploration, however, has now been held up for 10 years due to regulatory and environmental considerations, and it is still not clear when this will go ahead; and

- Coal bed methane (CBM): Several CBM resources are in the region and some with substantial volumes of gas in place. Amongst others, there are known CBM resources in Botswana, Waterberg and Mpumalanga in South Africa, the western side of Zimbabwe, and Tete in Mozambique. At this stage it would seem like these CBM resources are the first of the larger resources mentioned here, that will be exploited on large scale within southern Africa.

The distribution of these gas resources is shown in Figure 1.

Figure 1: Distribution of gas resources in southern Africa

There are also numerous smaller resources that have the potential to contribute to the southern African gas economy. These include the biogenic gas of the northern Free State province in South Africa, biogas from waste dumps or digester gas from sewerage works or animal farms:

- Biogenic gas: Biogenic gas is unconventional gas produced at great depth by microorganisms during respiratory and fermentation processes. Biogenic gas is not generally contained in traps, but is continually being generated at depth and migrates to surface along natural fracture systems, faults and dykes;

- Biogas: Biogas is a biofuel that is naturally produced from the decomposition of organic waste. When organic matter, such as food scraps and animal waste, break down in an anaerobic environment (an oxygen free environment) they release a blend of gases, primarily methane and carbon dioxide. Methane content is typically between 50 and 55%; and

- Digester gas: Digester gas is a category of biogas, produced from organic wastes such as livestock manure, and food processing waste in a controlled environment such as a biogas plant. Organic waste such as livestock manure and various types of bacteria are put in an airtight container called a digester, so the process could occur. Depending on the waste feedstock and the system design, biogas is typically 55 to 75 % pure methane.

It is not anticipated that any of these smaller resources in isolation has the potential to contribute more than 2 million GJ/a.

Apart from the above-mentioned ‘normal’ sources of natural gas, there is the possibility to produce synthetic natural gas (SNG). This used to be the basis of the gas industry in South Africa and even today, the gas going down the Lilly pipeline to KwaZulu-Natal is SNG, called methane rich gas (MRG) by the producer, Sasol. Various sources of SNG could be considered such as from gasification of coal, biomass, petroleum coke or solid waste, and the conversion of this gasified gas to SNG. Another possibility for SNG is a mixture of liquefied petroleum gas (LPG) and air, as is practiced on small scale in Port Elizabeth, South Africa.

Possible future scenario for natural gas in southern Africa

It is obvious that there is substantial scope for the growth of the gas industry in southern Africa. This is also supported by the latest Integrated Resource Plan (IRP) proposed by the South African government which foresees a much larger role for gas in electricity generation than is currently the case (additional 8100 MW from gas by 2030).

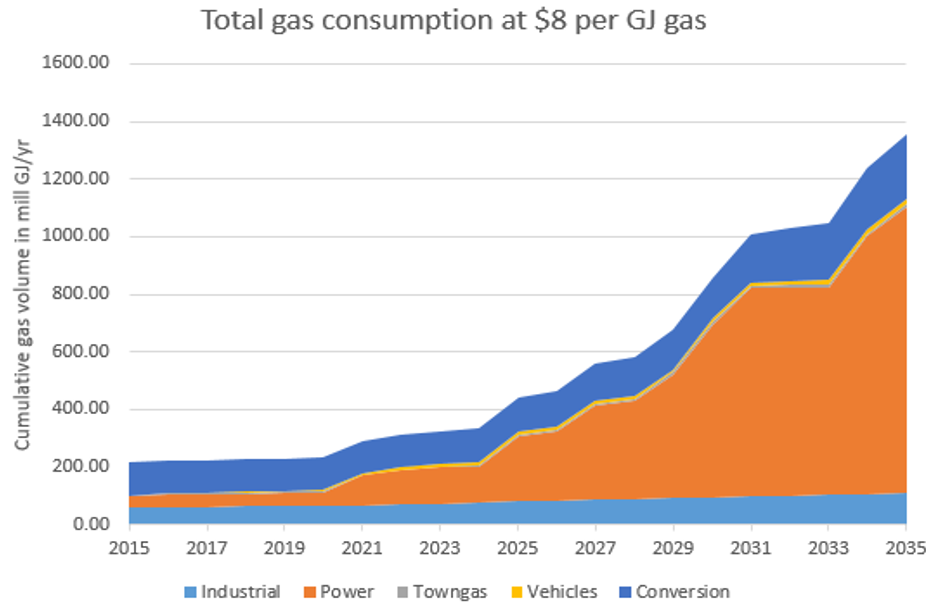

OTC runs a gas forecasting model, predicting the gas demand over the longer term. This model uses a wide range of assumptions and anticipates contributions from most of the potential sources of gas mentioned above. Under a set of optimistic macro-economic and project-specific assumptions, this model predicts growth in gas consumption in southern Africa as shown in Figure 2, when gas prices remain at the current levels.

Figure 2: Predicted growth in southern Africa gas consumption (from OTC model)

The following conclusions can be drawn from Figure 2:

- Growth in gas demand over the next 20 years will be driven by power generation;

- Gas consumption for derivative manufacture will become a much smaller proportion of the overall gas demand and more in line with global ratios;

- Industrial offtake of gas will only grow at modest rates and is inhibited by the lack of gas pipeline infrastructure;

- By 2035, gas-generated power production in the region will be roughly 13000 MW, which seems to be in line with the 11930 MW of installed gas-fired capacity in South Africa by 2030 as foreseen by the latest IRP (RSA DoE, 2018); and.

- By 2035, gas will then contribute 14% to the total primary energy supply of southern Africa, a similar level to the current contributions of gas in South East Asia where expensive LNG is used, but still short of the 20% level in northern Europe with similar natural gas prices.

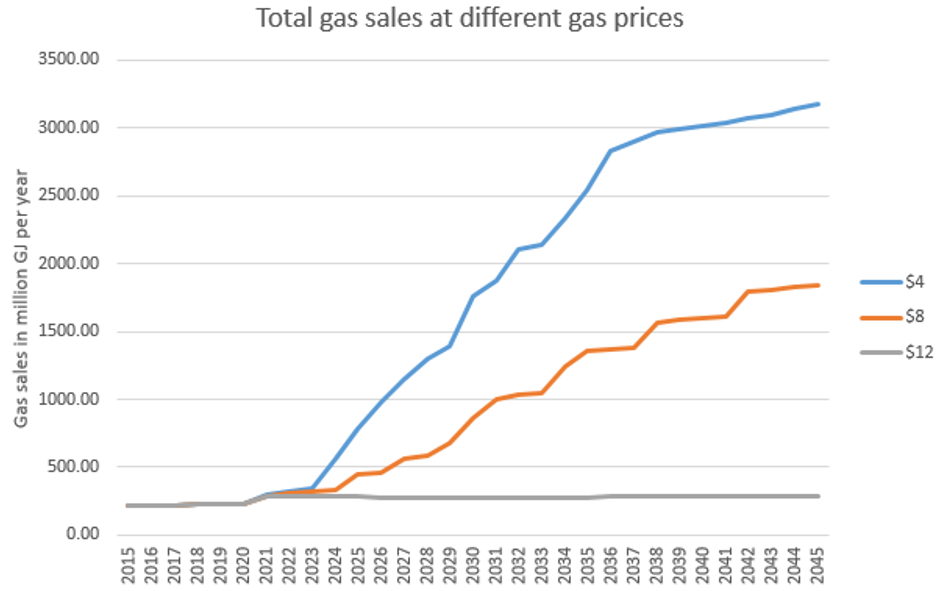

Gas competes with other primary sources of energy and as such growth in gas consumption will be very dependent on the price of the gas to the consumer. Figure 3 shows what the model predicts for gas growth at three different gas prices.

Figure 3: Impact of gas price on southern Africa gas consumption (from OTC model)

These three gas prices were selected to represent extremes of USA type pricing at the one extreme and imported LNG pricing at the other extreme. At least the following conclusions can be drawn from this analysis:

- LNG type pricing (the $12/GJ line in Figure 3) will not lead to significant growth in the southern African gas industry unless some other significant event(s) happens such as environmental regulations drastically impacting the generation of power from coal, steep increases in the price of electricity for other reasons or regulatory intervention that promotes the use of LNG imports.

- Low gas pricing (as represented by the $4/GJ line in Figure 3) can be a game-changer for the southern African economy. In the macro-economic assumptions underlying the model it is assumed that gas available in large quantities at such a low price would boost the GDP growth of the southern African economy by at least 1% per annum over this whole period.

Closing remarks

Gas is underutilised as an energy source in southern Africa. There is significant potential to grow the gas consumption in this region. Furthermore, if the gas price at which this growth occurs, is lower than the current gas prices, this development has the potential to have a noticeable positive impact on the economy of the region.

Over the past 10 to 15 years, several gas prospects have emerged in the region. Each of the four potential sources mentioned earlier has the potential to more than double the current gas consumption in southern Africa. If several of these sources are exploited in combination, it would change the energy landscape in southern Africa.

Infrastructure development, specifically pipeline networks, will remain a challenge in the region and could inhibit the growth of the gas industry. Governments in the region and state-owned entities (SOE’s) can play a significant role in facilitating the development of infrastructure.

References

BP Energy Review., 2018, BP Statistical Review of World Energy. Available from https://www.bp.com/content/dam/bp/en/corporate/pdf/energy-economics/statistical-review/bp-stats-review-2018-full-report.pdf Accessed on 27 August 2018.

RSA DoE (Department of Energy), 2018, Integrated resource plan 2018, final draft for public input. Available from http://www.energy.gov.za/IRP/irp-update-draft-report-2018.html. Accessed on 2 December 2018.

Putter, A.H., 2018, Insight article 055: Natural Gas in Southern Africa, Part 1: current natural gas supply and demand. Available from http://www.ownerteamconsult.com/natural-gas-in-southern-africa-part-1/ . Accessed on 10 November 2018.

Anton Putter

Consulting Partner

Anton holds a Chemical Engineering degree together with a number of advanced business qualifications in accounting, business economics and enterprise management. He has been closely involved with synthetic fuels ventures. More...

DOWNLOAD

You might also enjoy:

Small-scale versus Large-scale LNG Plants

By Jurie Steyn. Introduction Consumption of natural gas (NG) has grown rapidly over the past three decades and today accounts for nearly a quarter of the world’s primary energy supply. Although global primary energy consumption fell by 4,5% in 2020 due to the Covid-19...

Natural Gas for Power Generation

By Corne Thirion and Jurie Steyn Introduction The world needs an abundant supply of clean and affordable energy to support economic and social progress and build a better quality of life, particularly in developing countries. Until recently, this desire for energy has...

Outlets and Applications for Natural Gas

By Jurie Steyn Introduction South Africa’s energy sector has been in a state of insecurity for many years, and this will probably continue into the foreseeable future. Carbon emissions are high due to an over-reliance on coal as feedstock. This sets the scene for a...